5. DATA DESCRIPTION AND EXPLORATION

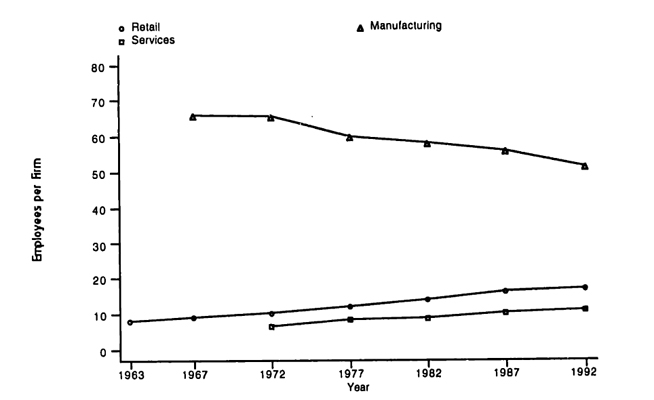

5.1 Trends in Firm Size

In order to show the trends in firm size for different industries, a number of graphs were constructed. The difference between manufacturing on the one hand and retail and services on the other is quite pronounced. As Figure 2 shows, firm size is clearly declining in manufacturing while it is growing in retail and services.24

One possible explanation for the changes at this high level of aggregation might be shifts in the relative importance of industries within a sector. For instance, it could be the case that manufacturing firms are actually growing within each industry, but firms are increasingly in industries with low firm size. To rule this out, simple time trends were calculated by industry and tabulated. Table 2 demonstrates that the majority of the changes in firm size is attributable to changes within industries rather than shifts in the distribution of firms across industries.

Table 2: Firm Size Time Trends

| Sector | - (90%)25 | - (ns)26 | + (ns) | + (90%) | P = 0.527 |

| Manufacturing | 13 | 3 | 3 | 1 | 0.0059 |

| Retail | 0 | 0 | 1 | 18 | 0.0000 |

| Service | 2 | 6 | 8 | 25 | 0.0001 |

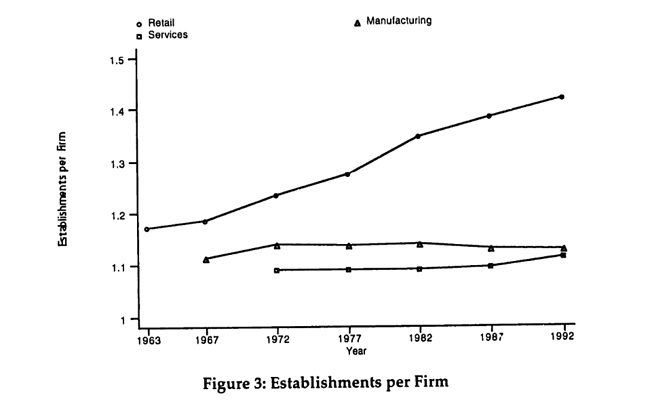

The changes in firm size can be broken down into changes in the number of establishments per firm and the number of employees per establishment.28 As can be seen in Figure 3, the establishments per firm have been increasing for retail since the 1960s and for services since the 1980s while they have been flat for manufacturing and even declining in the 1980s.

26 Same as the previous column, except that the trend is not statistically significant.

27 This is a simple non-parametric test, which indicates the probability that the observed pattern of positive and negative trends is the outcome of chance, Put differently, if the trend were equally likely to be positive or negative for any industry, how likely would the observed distribution be for this sector. The test is based solely on the number of positive and negative trends and does not take the significance into account.

28 An establishment is defined as a location at which the firm conducts business. For instance, for a retail chain each store is counted as a separate establishment. In manufacturing, an establishment corresponds roughly to a plant.

Again, by tabulating the time trends per industry this is seen to be mostly a "within" effect as shown in Table 3.

Table 3: Establishments per Firm Time Trends

| Sector | - (90%) | - (ns) | + (ns) | + (90%) | P = 0.5 |

| Manufacturing | 8 | 6 | 3 | 3 | 0.0577 |

| Retail | 1 | 3 | 2 | 13 | 0.0096 |

| Service | 4 | 8 | 10 | 19 | 0.0058 |

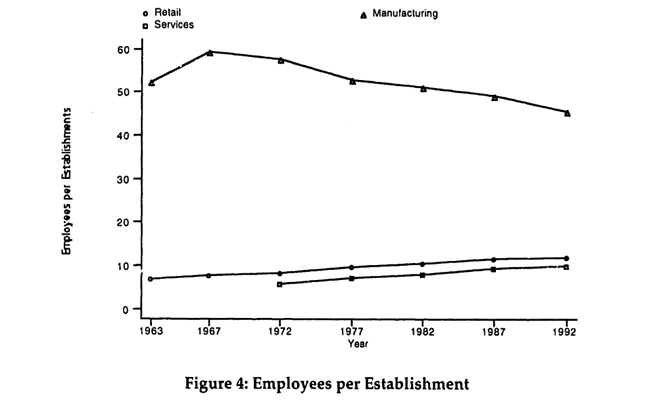

The number of employees per establishment has also changed, as shown in Figure 4

The number of employees per establishment has been decreasing significantly in manufacturing while it has been increasing in both the retail and service sectors. The tabulation of time trends shown in Table 4.

Table 4: Employees per Establishment

| Sector | - (90%) | - (ns) | + (ns) | + (90%) | P = 0.5 |

| Manufacturing | 12 | 5 | 2 | 1 | 0.0013 |

| Retail | 0 | 0 | 2 | 17 | 0.0000 |

| Service | 2 | 4 | 13 | 22 | 0.0000 |

The changes are summarized in Table 5, which shows the change in the composition of firm size between 1972 and 1992 for the three sectors.

Table 5: Firm Size Decomposition for All Firms

| Sector (Year) | Establ. / Firm | Empl. / Establ. | Empl. / Firm |

| Manufacturing 1972 | 1.14 | D7.68 | 65.75 |

| Manufacturing 1992 | 1.13 | 45.69 | 51.63 |

| Retail 1972 | 1.23 | 8.49 | 10.44 |

| Retail 1992 | 1.43 | 12.06 | 17.25 |

| Services 1972 | 1.09 | 5.98 | 6.51 |

| Services 1992 | 1.11 | 10.03 | 11.13 |

From Table 5 it would appear that in both the manufacturing and service sectors, the number of establishments per firm has been quite stable over time and that changes in firm size have been driven mostly by changes in the number of employees per establishment. This, however, obscures important changes in the relation between so-called single and multi-establishment firms. A multi-establishment firm is one that operates multiple establishments in the same industry.

Table 6: Share of Multi-Establishment Firms

| Sector (Year) | Establishments | Employees | Firms |

| Manufacturing 1972 | 19.8% | 73.6% | 8.7% |

| Manufacturing 1992 | 18.9% | 69.7% | 8.6% |

| Retail 1972 | 22.3% | 47.3% | 41.5% |

| Retail 1992 | 33.0% | 57.8% | 48.3% |

| Services 1972 | 10.9% | 32.8% | 2.7% |

| Services 1992 | 12.8% | 37.7% | 2.8% |

As Table 6 illustrates, multi-establishment firms have become more important in both the retail and service sectors while they have declined slightly in importance in manufacturing. Examining the breakdown into establishments per firm and employees per establishment for multi-establishment firms as shown in Table 7 further highlights the significant differences between the manufacturing sector on the one hand and the retail and service sectors on the other.

Table 7: Firm Size Decomposition for Multi-Establishment Firms

| Sector (Year) | Establ. / Firm | Empl. / Establ. | Empl. / Firm |

| Manufacturing 1972 | 2.61 | 213.48 | 557.18 |

| Manufacturing 1992 | 2.49 | 168.35 | 419.19 |

| Retail 1972 | 6.73 | 18.01 | 121.21 |

| Retail 1992 | 9.70 | 21.14 | 205.06 |

| Services 1972 | 4.35 | 17.99 | 78.26 |

| Services 1992 | 5.05 | 29.53 | 149.13 |

In summary, manufacturing is experiencing a decline in firm size, mostly due to a decrease in the number of employees per establishment. In the retail and service sectors, firm size is increasing not only due to an increase in the number of employees per establishment but also especially for multi-establishment firms due to an increase in the number of establishments per firm. These findings are consistent with the theorized ways in which IT may affect firm size, In particular, the decrease in employees per establishment in manufacturing is consistent with the distribution of physical assets across firms and the substitution of physical assets for human assets. Similarly, the increase in establishments per firm in retail and services is consistent with a concentration of information assets and the increase in employees per establishment is consistent with a complementarity between information assets and human assets.

An important caveat is that all of these graphs and tables consider US establishments and employment only. It is therefore quite conceivable and even plausible that manufacturing firms have experienced more international growth than retail and service firms. This explanation is an important alternative that unfortunately cannot be examined using the currently available information. It does not, however, change the fact that the number of employees per manufacturing establishment has clearly been decreasing.

5.2 Trends in Physical Assets

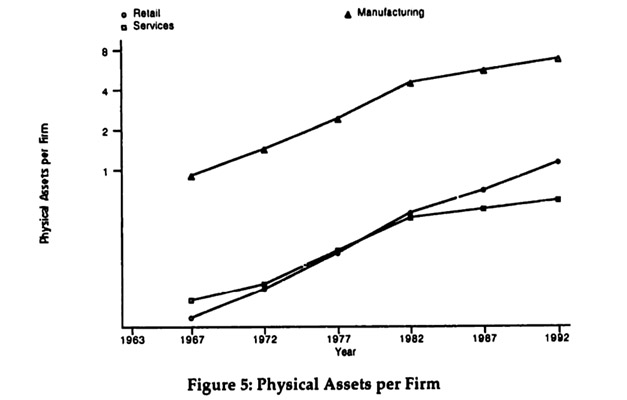

Various measures of physical asset intensity are conceivable. The one most pertinent to the issue at hand is the physical assets per firm, The trends in gross physical assets per firm (equipment plus structures) in current prices are shown in Figure 5 using a logarithmic scale.

Figure 5 confirms the expectation that manufacturing firms tend to bring together significantly more physical assets per firm than retail and service firms do. The growth in physical assets per firm has slowed down in all three sectors since 1982, but especially so in the services and manufacturing sectors. This slow¬down is consistent with the notion that information assets are becoming more important relative to physical assets.

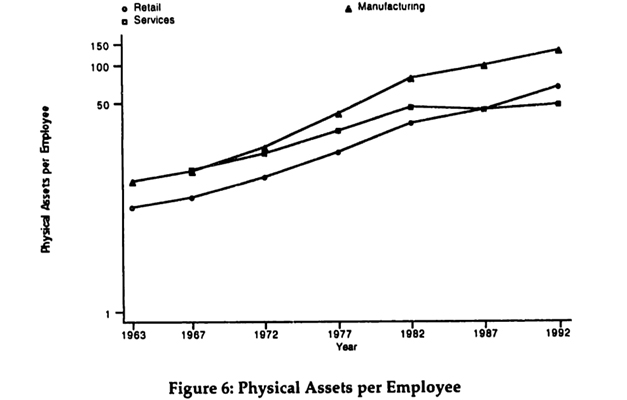

The picture hardly changes when capital per employee is considered as shown in Figure 6. This measure confirms that there has been a slow-down in the growth of physical assets. Surprisingly, Figure 6 shows that in the 1960s there was little difference between the retail, service, and manufacturing sectors. The widening gap over time, especially between the manufacturing and service sectors, is evidence consistent with an increased importance of information assets as a factor of production in the service sector.

For the manufacturing sector, the Census data also contains a breakdown of investment in physical assets between single and multi-establishment firms. The fraction of investment by multi-establishment firms peaked in 1982 at 88% and declined to 85% by 1992. This trend reversal is especially pronounced in the product manufacturing industries when compared to process industries as can be seen in Table 8.29

Table 8: Share of Investment in Physical Assets by Multi-Establishment Firms

| Product Mfct. Industries | 1963 | 1967 | 1972 | 1977 | 1982 | 1987 | 1992 |

| Textile Products | 77% | 80% | 80% | 83% | 88% | 86% | 82% |

| Fabricated Metal | 65% | 71% | 71% | 71% | 73% | 76% | 67% |

| Industrial Machinery | 70% | 75% | 77% | 80% | 81% | 77% | 76% |

| Transport Equipment | 87% | 94% | 95% | 96% | 96% | 86% | 88% |

The reversal of the trend in the share of multi-establishment firms is consistent with the idea that physical assets are becoming more flexible, due to embedded IT.30 The more flexible assets are then distributed across more firms and especially smaller firms with only a single establishment. The trend reversal is also consistent with the reduced coordination cost argument.

5.3 Trends in Human Assets

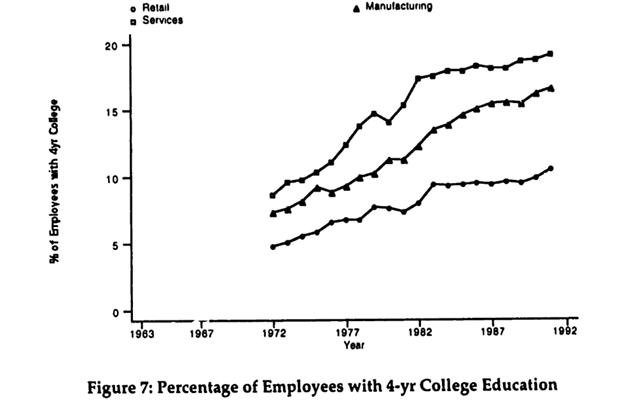

Direct measures of the skill of human assets are difficult to obtain. The best available measure is the degree of schooling of the work force in a particular industry. Schooling contributes directly to skills and also serves as an indicator for whether or not employees are likely to receive on-the-job training.31 Figure 7 shows the trends in the percentage of college graduates for the three sectors.32

As Figure 7 shows there has been a significant increase in the share of college educated employees across all three sectors, which likely reflects general improvements in education. There are, however, differences between the sectors, which are summarized in Table 9. After strong increases throughout the 1970s, there was a marked slowdown in both the service and retail sectors in the growth of the percentage of college graduates. As a result, the gap between services and manufacturing has narrowed while the gap between manufacturing and retail has widened.

32 The service sector does not include healthcare and education, for which data is only available starting with the 1982 Census, but it does include legal professionals.

Table 9: Annual Increase in Percentage of College Educated Employees

| Sector | 1973 - 1982 | 1983 - 1992 |

| Manufacturing | 0.4% | 0.3% |

| Retail | 0.3% | 0.1% |

| Service | 0.7% | 0.2% |

The graph and table look similar when the percentage of employees with at least some graduate education is considered. If the argument about changes in the employment relationship to outside contracting holds, the effect should be strongest in manufacturing (especially after 1982).

5.4 Trends in Information Assets

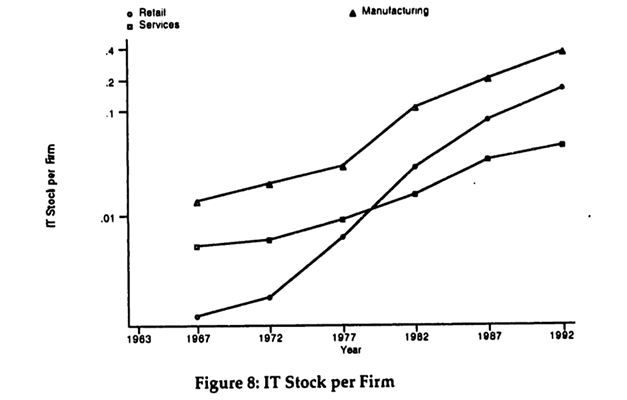

As discussed above, investment in IT will serve as a proxy for the importance of information assets. Several categories of the investments published by the BEA could be interpreted as IT. The two included here are OCAM (Office Equipment, Computers, Accounting Machinery) and Communications Equipment. The net IT capital stock per firm is graphed in Figure 8 using a logarithmic scale.33

Figure 8 shows that IT stock has been built up at an exponential rate. The even faster growth after 1977 is due to the deployment of personal computers and rapidly growing investments in communication equipment. Figure 9 also reveals that the retail sector has been the most aggressive in adopting IT.

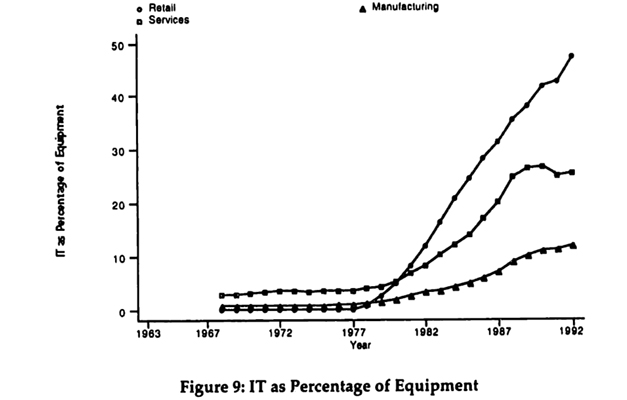

In order to illustrate the relative importance of IT capital compared to other equipment. Figure 9 graphs the net IT stock as a percentage of total net equipment stock for each of the three sectors.

Figure 9 is consistent with the argument that information assets are likely to be of greater relevance compared to physical assets in the retail and service sectors than in the manufacturing sector. This interpretation is confirmed by considering the relation of book to market values for publicly traded firms in the three sectors in 1990, as shown in Table 10.34

Table 10: Book to Market Ratios

| Sector | Book Value | Market Value | Ratio | Sample Size |

| Manufacturing | 5,329 | 5,195 | 1.03 | 435 |

| Retail | 3,663 | 3,607 | 1.01 | 78 |

| Service | 2,438 | 3,005 | 0.81 | 27 |

The higher market values relative to book values especially for firms in the service sector35 are consistent with a more important role of intangible information assets in these sectors when compared to manufacturing.

5.5 Simple Correlations

In addition to the trends, it is useful to consider some simple correlations. As was argued above, the effect of physical assets should be the result of increased productivity and increased flexibility. Since direct measures are not available, changes in physical asset intensity will be used instead. First, consider the correlation between "differences" in physical asset intensity36 and firm size as shown in Table 11. The differences are the changes from one census year to the next, e.g. from 1972 to 1977.

Table 11: Diff. Correlations btw. Physical Asset Intensity and Firm Size37

| Sector | Coefficient | Significance | Observations38 |

| Manufacturing | -0.2549 | 0.012 | 95 |

| Retail | -0.1838 | 0.092 | 85 |

| Service | 0.0626 | not significant | 130 |

The results in Table 11, are consistent with the arguments that increased flexibility and productivity of physical assets due to embedded IT, as well as reduced coordination costs contribute to decreases in firm size as measured by the number of employees per firm. As expected, the effect is strongest in the manufacturing sector.

This finding is confirmed by considering correlations for levels of the same measures "within" each industry. Since only a few data points are available for each industry, the results are tallied and a non-parametric test is applied to determine the likelihood that the outcome was chance. The results are shown in Table 12.

37 There is a potential for simultaneity with respect to exogenous changes in output, since this might lower sales (and hence increase physical asset intensity) at the same time as the number of employees (and hence firm size), thus inducing negative correlation. The actual bias appears to be minimal, since the results are virtually identical when using total physical assets.

38 One or two industries were excluded in each sector, because they were outliers, which differed by more than three standard deviations from the other industries in the sector. These are the same industries which were later excluded in the exploratory regression analyses (see footnotes there for details).

Table 12: Within Correlations btw. Physical Asset Intensity and Firm Size

| Sector | Negative | Positive | P = 0.5 |

| Manufacturing | 16 | 3 | 0.0022 |

| Retail | 8 | 9 | 0.5000 |

| Service | 13 | 12 | 0.5000 |

Table 12 confirms that the effect of changes in physical assets is more important in the manufacturing sector than in the retail and services sectors.

It was argued above that increases in the skill level of human assets may result in a transition away from employment relationships and hence contribute to a decrease in firm size. The difference correlations between human assets, measured as the percentage of employees in an industry with a 4-year college education, and firm size are shown in Table 13.

Table 13: Diff, Correlations btw. Human Assets (4-yr) and Firm Size

| Sector | Coefficient | Significance | Observations |

| Manufacturing | 0.0762 | not significant | 72 |

| Retail | -0.0050 | not significant | 68 |

| Service | -0.0572 | not significant | 102 |

Additional insight can be gained by considering the within correlations. The results are shown in Table 14.

Table 14: Within Correlations btw. Human Assets (4-yr) and Firm Size

| Sector | Negative | Positive | P = 0.5 |

| Manufacturing | 17 | 2 | 0.0004 |

| Retail | 0 | 18 | 0.0000 |

| Service | 5 | 20 | 0.0020 |

The coefficients have the expected negative sign only for manufacturing, whereas they are exclusively or predominantly positive for both retail and services.39 The results change somewhat when a stricter measure of human assets is applied, such as at least some graduate education. In that case 4 out of 18 coefficients turn out negative in retail and 10 out of 25 in services. On the whole, the correlation evidence for human assets does not fit well with the expectations and this contrast is explored further in the following sections.

Finally, consider information assets. It was argued that the increased use of IT makes information assets more important. Since information assets are complementary with human assets and tend to be concentrated, this should result in an increase in firm size as measured by the number of employees per firm. The difference correlations are shown in Table 15 and the within correlations in Table 16.

Table 15: Diff, Correlations btw. Information Assets40 and Firm Size

| Sector | Coefficient | Significance | Observations |

| Manufacturing | 0.1898 | 0.065 | 95 |

| Retail | 0.1398 | not significant | 85 |

| Service | 0.0806 | not significant | 132 |

Table 16: Within Correlations btw. Information Assets and Firm Size

| Sector | Negative | Positive | P = 0.5 |

| Manufacturing | 16 | 3 | 0.0022 |

| Retail | 0 | 18 | 0.0000 |

| Service | 8 | 17 | 0.0539 |

The change between the difference and within correlations for manufacturing is surprising and warrants further attention. One possible explanation is that the within correlations are affected by "omitted" variables. In particular, in manufacturing the effects of both physical assets and human assets were seen above to be strongly negative for firm size. The information assets measure turns out to be significantly correlated with the human asset measure41 and may therefore pick up its effect. The next section attempts to sort out these conflicting results by considering the results of exploratory regression analyses, which determine the proper "partial" effects.

40 Information assets are measured as the share of net IT stock in the net total equipment stock.

41 The correlation coefficient is 0.5255 (95 observations, significance 0.0001).

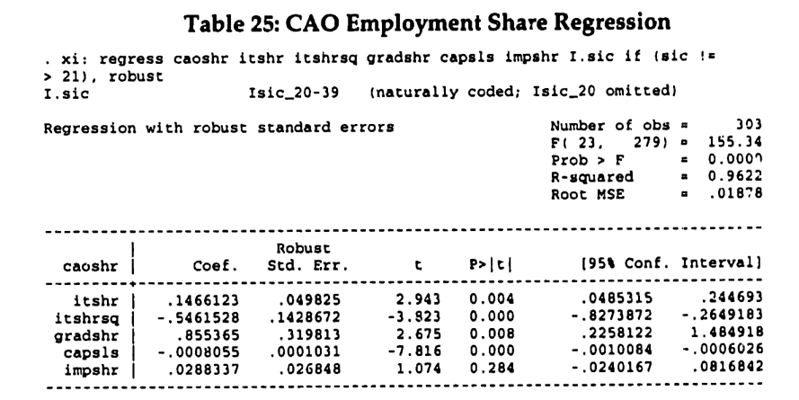

5.6 Exploratory Regressions

The exploratory regressions were run on pooled data using industry dummy variables.42 This approach raises several econometric issues. First, since the size of the industries varies considerably, heteroskedasticity is a potential problem. Accordingly, robust standard errors are reported throughout.43 Second, serial correlation may be a problem in time series regressions. Given the five year intervals between census years, this is not likely to be a problem here, as was confirmed by Durbin-Watson statistics not significantly different from 2 (no serial correlation). Third, there are questions of simultaneity. Since these are exploratory regressions, no formal corrections—such as two stage least squares—were attempted. Instead, the independent variables were chosen to minimize the likelihood of simultaneity. In particular, instead of total investment levels for IT, the fraction of IT stock as a percentage of total equipment was used.

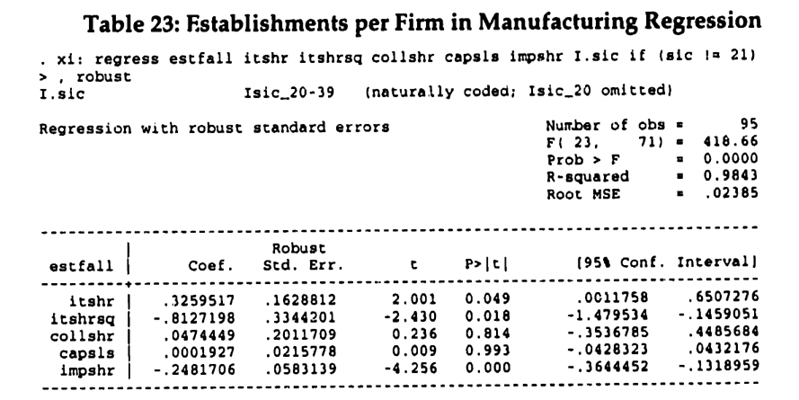

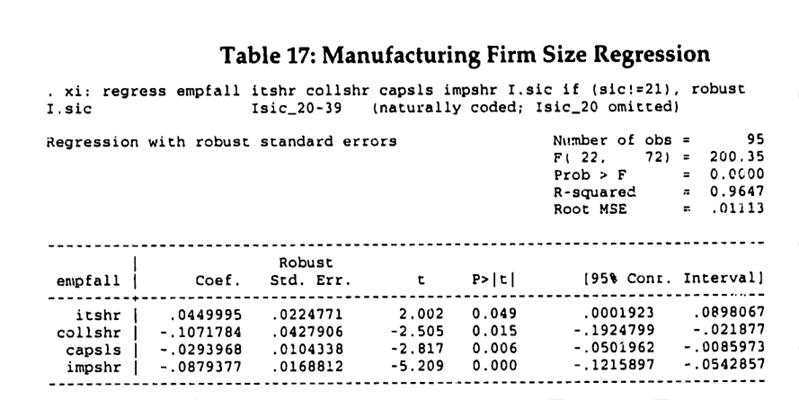

5.6.1 Exploratory Regression for Manufacturing

The manufacturing regression uses the number of employees per firm for all firms as the dependent variable (empfall) and the following independent variables:

| -itshr: | share of IT stock in total equipment (net stocks) to measure information assets relative to physical assets44 |

| -collshr: | share of employees who completed 4-yr college to measure the skill level of human assets |

| -capsls: | physical asset intensity of sales |

| -impshr: | share of imports in total market to measure the effects of trade in the industry |

The results of this regression are shown in Table 17, with the industry dummy variables omitted. Note that one industry (SIC 21, Tobacco Products) was omitted because a residual plot revealed that it was an outlier.

43 Robust standard errors were calculated using the Huber-White estimator (Pindyck and Rubinfeld 1991).

44 An absolute measure of IT stock would be more likely to pick up a substitution effect from automation. The relative measure is meant to capture the importance of information assets. It also helps to reduce simultaneity effects between firm size and investment.

What is most surprising about the result is the contrast with the findings of BMGK, whose results suggested that the increased use of IT was associated with smaller firms. There are several important differences between the present regression and the BMGK analysis that help explain this contrast:45

- The current regression contains an explicit measure of the effects of human assets, which were not directly accounted for in BMGK.

- The measure of IT used here includes communication equipment, which was not included in BMGK.

- BMGK employ absolute measures of IT and total equipment investment, whereas the independent variables here are relative measures (IT as a fraction of equipment and capital intensity of sales).

- SIC 21 (Tobacco products) was included in the BMGK regressions, but excluded here since a residual plot showed it to be an outlier given the specification used here.46

The results of regressions with a specification closer to BMGK are shown in Table 18.

46 In the pooled regressions the same model is applied to all industries within a sector. Industries for which the fit appeared especially poor were excluded from these exploratory analyses (industries with residuals more than three standard deviations out).

Table 18: Comparison to BMGK

| BMGK-type specification | BMGK plus human assets | |||

| Variable | Coefficient | Significance | Coefficient | Significance |

| IT | -.0041722 | 0.097 | .0015025 | 0.582 |

| Equipment | .0183582 | 0.173 | .0308703 | 0.020 |

| Trade | -.0951059 | 0.064 | -0014399 | 0.979 |

| Education | N/A | N/A | -.372123 | 0.000 |

The coefficients in the BMGK-type specification for both IT and equipment have the same signs as in BMGK. Adding the explicit measure of human assets, however, reverses the sign on the coefficient for IT. This suggests that in BMGK the IT coefficient picks up the effects of more highly skilled human assets which, as was argued above, are likely to be complementary to the use of IT.

The coefficient on equipment is positive in BMGK and in the regressions following their specifications here. This result changes when the tobacco products industry (SIC 21) is excluded. BMGK use the number of employees per establishment as the dependent variable in most of their regressions. In the one where they use the number of employees per firm, as is the case here, the effect of equipment investment is not significant. In fact, the equipment variables which are lagged by more than one year receive negative coefficients. In combination, these changes in specification and data appear to explain the different sign on the coefficient for equipment. The negative coefficient for the capital intensity of sales found here is consistent with the ideas of capital-labor substitution and distribution of physical assets.

The one result from BMGK that could not be replicated here for any specification is the positive and significant coefficient for the effects of trade on firm size. In all regressions here, the effect was negative or not significant. The regressions here use the import share instead of the total trade share (i.e. the numerator of the measure is imports as opposed to imports plus exports). This change does not explain the difference in the sign of the coefficient. Imports and exports are highly correlated (> 92%) and regressions using the trade share measure were not noticeably different. The negative coefficient is consistent with the hypothesis that trade liberalization results in a relocation of manufacturing establishments to lower wage countries. The negative coefficient is also in line with related empirical research. For instance, one study (Caves and Krepps 1993) showed that increases in trade resulted in a reduction in employment by American firms.47

5.6.2 Exploratory Regression for Retail

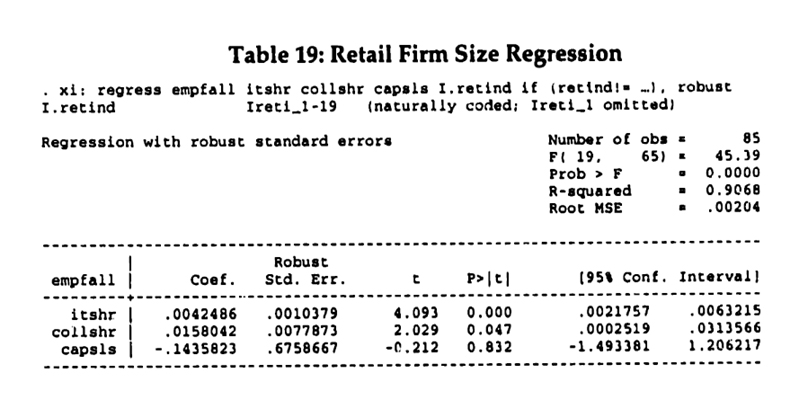

The regression for the retail sector uses the number of employees per firm as the dependent variable (the independent variables are as before, but do not include the import share). The results are shown in Table 19.48

As expected, physical assets as measured by the capital intensity of sales turn out not to be a significant factor in retail confirming the results from the simple correlations.

The positive and significant coefficient on human assets, however, is a surprising result at first. A likely explanation involves simultaneity, which is not controlled for here. Small retail firms with a single or a few stores usually do not have any central functions (e.g. central purchasing, human resources) where more highly skilled human assets are likely to be required. Large retail firms that operate chains of many stores on the other hand are known to have centralized a lot of decision making (for instance, most of Wal-Mart's product selection is handled at headquarters). This explanation of the positive coefficient for human assets is supported by considering separate regressions for the employees per retail establishment and the establishments per retail firm. Human assets are a significant factor only for the latter. Further confirmation is provided below by regressions which explicitly consider employees in centralized functions.

48 Department stores and shoe stores were excluded as outliers based on a residual analysis.

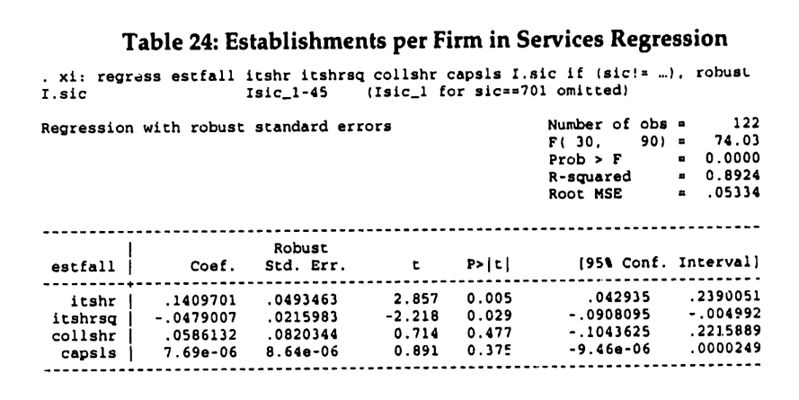

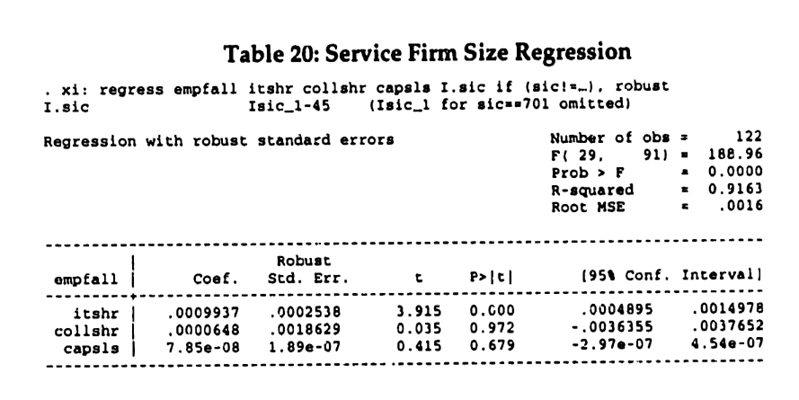

5.6.3 Exploratory Regression for Services

Finally, similar regressions were examined for the industries in the service sector. The results for the basic specification are shown in Table 20.49 As in the retail sector, physical asset intensity does not seem to be important in determining firm size in the service sector. Information assets, as measured by IT, have a strong and highly significant positive effect on firm size.

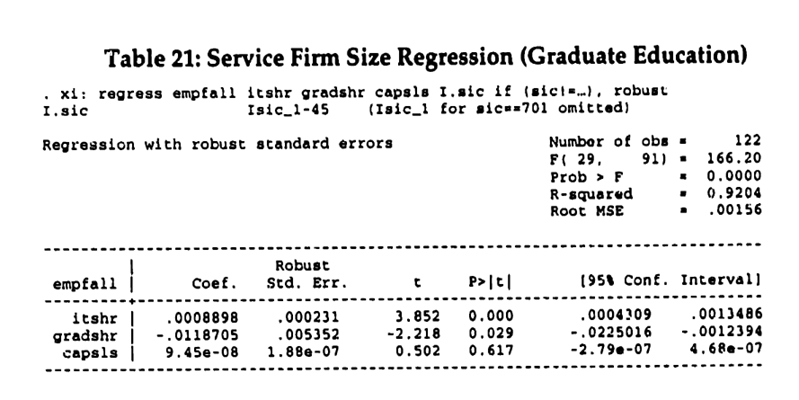

Surprisingly, human assets also do not appear to be a significant factor. The service sector was seen to have the highest level of human assets and so it is possible that college education is not a sufficiently strong discriminator between industries. The results of using the percentage of employees with at least some graduate education instead are shown in Table 21.

Now the increased importance of human assets can be seen to result in reduced firm size. Physical assets do not appear to have a significant effect on firm size for the service sector.